Watercraft & Private Aviation Insurance

Protect your boat, yacht or private jet with a tailored policy.Boats and Aircraft can be a lot of fun, as well as provide wonderful time with family and friends. They can also cause a significant monetary drain if you don’t have the right personal insurance. They can be damaged by wind, rain, hail, lightning and waves; by fire; by theft or vandalism; by collisions; or during transport. The right insurance can protect you from all of these calamities and more.

FRP Private Client partners with our insurers to offer protection for personal watercraft and aircraft of all sizes and types.

What is Watercraft & Private Aviation Insurance?

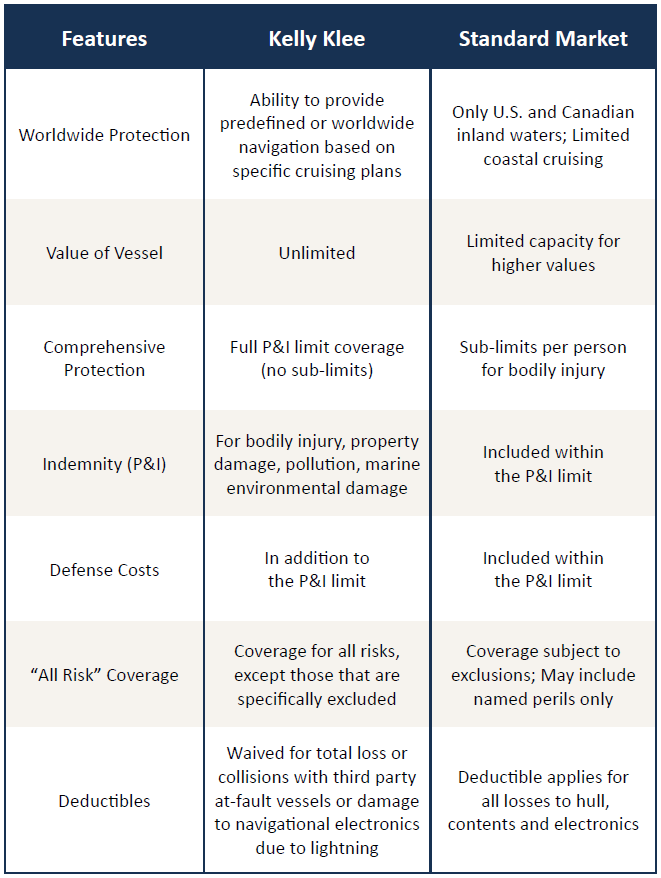

Protection beyond standard insurance policies.

How much coverage do you need?

Special care is required when evaluating coverage for both Aircraft and Watercraft.The best protection you can have is “Agreed Value” coverage. In the event of a total loss, the insurer will pay you the full insured amount. You’ll want to steer away from “Actual Cash Value” coverage, which deducts depreciation from your benefit.

Some insurers will incorporate new ownership into their rate calculations because of claims related to inexperienced owners. FRP Private Client recommends that all boat owners, especially first-time owners, complete a boating safety course.

A Special Class of Coverage

AGREED VALUE OPTION

Pays the value that you’ve agreed on with the insurance company ahead of time if your vessel is a total loss.

UNINSURED BOATER

Provides coverage if you or the guests on your boat are injured as a result of the actions of another boater who does not have boat liability insurance (which is not a mandatory coverage for all boaters).

PROPERTY COVERAGE

Pays for items damaged or destroyed on board a vessel, including tenders, fine art, personal property and furnishings.

LIABILITY PROTECTION

Can be customized to meet your needs and may include legal defense costs, pollution clean up and containment, marine environmental damage and wreck removal.What Does Watercraft and Private Aviation Insurance Cover?

Enjoy your journey knowing you are properly covered.Whether it be a high-value automobile or a high-value yacht or boat, having proper insurance protection in place is essential. Just as being on the water provides feelings of peace and calmness, so does knowing that if the unexpected happens, your yacht or boat insurance is going to provide you the financial protection you need.

Generally, anyone who has your permission to drive your boat is covered. The exceptions to this are your boat being operated by professional marine personnel and if the policy has a “Named Operator” endorsement that only covers listed operators.

Most policies include liability for water sports. Consult with FRP Private Client if you plan on using your boat for water skiing, wakeboarding, or other water sports.

Typically, your vessel will only be covered by your homeowner’s insurance if damage occurs while it’s on your property. Check with FRP Private Client and verify the limits on your high-value homeowner’s policy.

We recommend an “All Risk” policy, which covers most types of losses. Typical exclusions include:

- Normal wear and tear

- Marring

- Denting

- Scratching

- Animal damage

- Manufacturer’s defects

- Design defects

- Ice and freezing

How to get Started

A plan tailored

to your needs.

After taking time to understand your coverage needs, a personal risk manager will prepare a custom plan designed to protect what's important to you. We take a holistic approach to risk management that looks at your entire portfolio of risks to ensure you are properly covered. No detail is overlooked.